From Restarting to Rebuilding:

Your Financial Progress Should Travel With You.

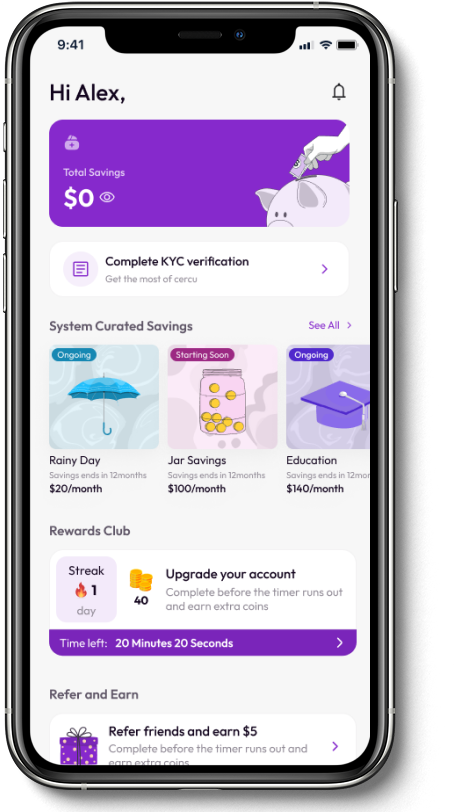

Welcome to Cercu

Our Mission is to empower communities to build strong and evolving financial identities by providing accessible, inclusive, and transparent decentralized financial solutions that overcome barriers, foster trust, and drive financial inclusion for all.

Our Vision: Your financial identity doesn’t start when you arrive; it continues and evolves.

Founder’s Note

“As an immigrant, I know what it feels like to be financially invisible—to have your financial progress erased just because you moved. Cercu was born from that frustration, and from a vision of a world where financial identity is portable, community trust is valued, and opportunity is inclusive.” – Adeyori Onashile, Founder

Why Choose Cercu

Starting over shouldn't mean starting from scratch. For millions of immigrants and underbanked individuals, moving to a new country means becoming financially invisible. No local credit history. No access to fair tools. No proof of your financial responsibility—even if you’ve been saving, contributing, or borrowing responsibly for years.

Traditional financial systems weren’t built for you, Cercu is.

We believe your financial story should be portable, verifiable, and community-powered—no matter where life takes you.

✨ Our 3 Core Solutions

Cercu: Your financial identity doesn’t start when you arrive. It continues and evolves.

💰 Smart Group Savings (DCS)

- Cercu digitizes trusted community savings models like ROSCAs—making them automated, transparent, and secure. Contribute with people you trust. Build financial discipline. Support others and receive support when it’s your turn.

🌍Portable Financial Identity (PFI)

- We help you carry your financial credibility with you—across borders. Cercu turns your contributions, repayments, and even credit history from your home country into a verifiable financial identity you control.

💳 Cercu Credit Card

(Coming Soon)

- Access credit based on your Cercu trust score, not outdated credit checks. Designed for those overlooked by traditional systems, our credit card is backed by your real behavior—not your postcode or paperwork.

💎 Foundational Principles

Cercu: A Next-Gen Financial Platform Built on Five Foundational Principles

Cercu isn’t just another fintech: We’re redefining financial inclusion by empowering communities with tools that are transparent, portable, and trust-based. Our platform is built on four foundational principles that shape every product, experience, and feature we deliver.

Community-First Savings

Community-First Savings

Financial Identity Without Borders

Financial Identity Without Borders

Privacy You Own

Privacy You Own

Trust, Earned Through Action

Trust, Earned Through Action

🔄 How Cercu Works

Choose your path—whether you’re joining a group, building your financial identity, or just getting started with credit history.

- Verify Your Identity (KYC) Sign up securely using your phone number, government ID, and biometric verification. We ensure full compliance with data protection and regulatory standards.

- Build Your Profile Connect your bank account or upload verified credit history from your home country. Every action—from contributions to consistent savings—strengthens your financial identity.

-

Choose Your Path

• 🤝 Join a Group (Optional): Participate in community savings circles and earn real trust by contributing and supporting others.

• 🌍 Go Solo: Use Cercu to build and carry a Portable Financial Identity over time—without joining a group.

• 💳 Plan Ahead: Get ready for the Cercu Credit Card, designed to approve users based on trust, not just scores.

-

Earn, Build & Share Your Financial Identity

Every action—saving, contributing, repaying—generates verifiable signals that shape your Cercu trust profile.

Here’s where your financial identity opens doors:

🏦 Finance: Lenders, Remittance platforms, Micro-insurance

🏘️ Housing: Property managers, Rental platforms.

🧳 Migration: Embassies, Refugee programs, Government agencies.

👷♀️ Gig Economy: Freelance platforms, Earnings advance, Cooperatives.

🎓 Education: Student housing, Aid programs.

💼 Employment: Background checks, HR tools, Workforce access With Cercu, your reliability is visible—and that changes everything. - Unlock Access Use your Cercu identity to get credit, prove financial trustworthiness, and access new opportunities—across borders, platforms, and communities.

🚀 Core Value Proposition

Cercu gives you access, dignity, and financial progress—no matter your starting point.

With Cercu, you can:

✅ Join savings circles that are fair, transparent, and rewarding

✅ Build a portable financial identity tied to your real behavior

✅ Port your credit history from your home country

✅ Earn trust and unlock access to credit tools—including our upcoming Cercu Card

✅ Feel seen, supported, and empowered to grow.

👥 Testimonials & Community Voices

Real stories from real people building trust with Cercu:

"They told me I needed to pay up to 12 months of rent upfront—just because I had no Canadian credit history. No one asked about my saving habits or financial discipline—nothing."

We’ve contributed to group savings, repaid loans, supported others—but none of that ever counted. Each time we moved, our financial worthiness was erased.

These are just two of millions of stories from financially responsible newcomers who are invisible to the systems they enter. Cercu is changing that—by turning invisible trust into visible opportunity.

“Join a growing community building financial credibility across borders.”FAQ (Frequently Asked Questions)

Who is Cercu for?

Cercu is for immigrants, newcomers, and underbanked individuals who want a fair, secure, and inclusive way to save money, build trust, and access financial tools.

Do I need a credit history to join Cercu?

No. You can join with just your phone and ID verification. We’ll help you build or port your financial history over time.

How is Cercu different from a bank?

Cercu doesn’t replace your bank—it enhances what you can do. We help you build your financial identity, join trusted group savings, and access tools your bank might not offer.

Is Cercu safe and secure?

Yes. We use blockchain-based smart contracts, encrypted data handling, and privacy-preserving identity systems to ensure your data and funds are protected.

What happens if someone in my savings group doesn’t pay?

Each Cercu group includes a built-in trust and insurance model. We score and flag behavior transparently, and users are matched to groups they can grow with over time.

Can I port my credit history from my home country?

Yes. We help you bring in your verified credit reports or financial behavior data from select countries, so you don’t have to start over.

📰 Featured-in Article

We’re proud to be recognized by leading platforms supporting innovation and financial inclusion.

Ecosystem Partners & Builders

Build with Trust. Power Inclusion.

Cercu isn’t just a savings app—it’s a decentralized identity and trust engine. At the core is the Cercu Trust Engine™, our proprietary framework that turns everyday financial behavior into real-world access.

Our API and verifiable credentials let you integrate trusted financial identities into your own systems—so you can serve more people, more fairly.

Where can Cercu plug in?

Finance: Lenders · Remittance · Micro-insurance

Housing: Property Managers · Rental Platforms

Migration: Embassies · Refugee Programs · Government Agencies

Gig Economy: Freelance Platforms · Earnings Advance · Co-ops

Education: Student Housing · Aid Programs

Employment: Background Checks · HR Tools · Workforce Access

Final CTA + Waitlist Hook

Join the Movement to Redefine Financial Trust. Whether you're new to your country, tired of being overlooked, or ready to take control of your financial story—Cercu is for you.

Join Our Team

🔍 Blockchain Developer (Remote / Canada Preferred)

We’re looking for a passionate Blockchain Developer who is excited about building a more inclusive financial future. If you’re someone who thrives at the intersection of decentralized technology and real-world impact, we want to hear from you.

You might be a fit if you:

- Have experience with smart contracts, DeFi protocols, or identity frameworks (Solana or EVM chains preferred)

- Are familiar with ZKPs, DID standards, or verifiable credentials (a plus)

- Believe in financial inclusion and community-first innovation

- Enjoy working with mission-driven startup teams

What you’ll do:

- Build and maintain core smart contract infrastructure

- Collaborate with product and design to bring new features to life

- Help define Cercu’s decentralized trust and identity architecture

Apply now or refer a friend: careers@joincercu.co